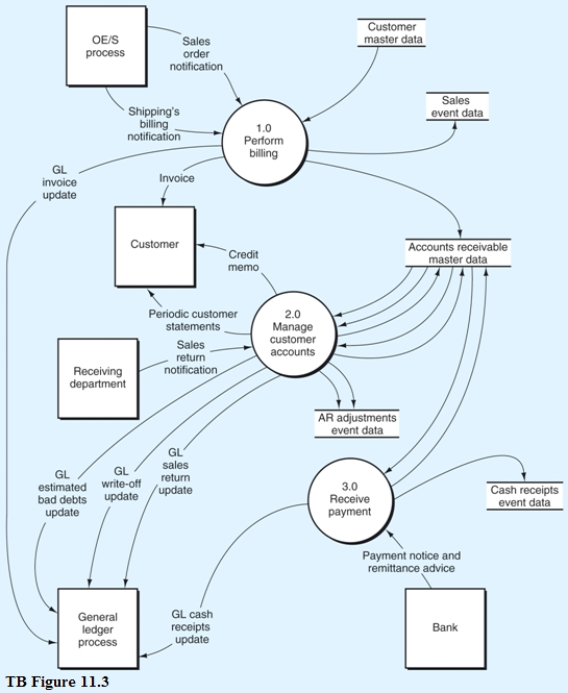

Below is the narrative of the "Manage customer accounts" portion (i.e., bubble 2.0) of the B/AR/CR process.

Narrative Description

Processes 2.1 through 2.3 relate to sales returns adjustments. This process begins when there is notification from the receiving department that goods have been returned by a customer. Subprocess 2.1 obtains data from the accounts receivable master data to validate the return. If the sales return is not valid, it will be rejected (see Reject stub) and processed through a separate exception routine. If the sales return is valid, it is sent to subprocess 2.2 where a credit memo is prepared and sent to the customer, and the accounts receivable master data is updated to reflect the credit. At the same time, the validated sales return is sent to subprocess 2.3 where a journal voucher is prepared, which is used to create a record in the AR adjustments event data store (i.e., the journal), and the general ledger is notified that a credit memo has been issued. This results in updates to sales returns and allowances and to AR.

Process 2.4 is triggered by a periodic review of aging details obtained from the accounts receivable master data. The aging details would be used to identify and follow up on late-paying customer accounts. One of two types of adjustments might result from this review:

The recuring adgusting entry for estimated bad debts.

The periodic wite-off of "definitely warthess" customer accounts Like process 2.4, bubble 2.5, "Prepare customer statements," also is triggered by a periodic event that recurs at specified intervals, often on a monthly basis in practice. Details of unpaid invoices are extracted from the accounts receivable master data and are summarized in a statement of account that is mailed (or sent electronically) to customers.

Required:

From the DFD in TB Figure 11.3 and the narrative description above, explode bubble 2.0 into a lower-level diagram showing the details of that process.

Correct Answer:

Verified

Q124: The control plan _ ensures that invoices,

Q125: To help prevent incoming cash receipts from

Q126: The control plan _ controls the billing

Q127: The control plan _ establishes for the

Q128: Below is the narrative of the "Manage

Q129: The E-R diagram below represents a B/AR/CR

Q131: The following narrative describes a cash receipts

Q132: The following is a list of 10

Q133: An organization can accelerate cash deposits and

Q134: The control plan _ assumes that there

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents