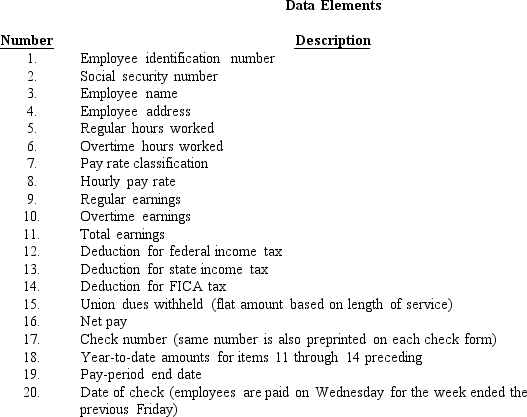

Assume you are working with a payroll application that produces weekly paychecks, including paystubs. Listed below are 20 data elements that appear on the paycheck/paystub.

Required:

Required:

For each numbered item, indicate the immediate (versus ultimate) source of the item. For instance, the immediate source of the number of exemptions for an employee would be the employee master file as opposed to the ultimate source which is the W-4 form filed by the employee. Some items may have more than one source, as in the case of item 1. You have the following choices:

Arrange your answer as follows:

Correct Answer:

Verified

Q108: _ employees are employees who do not

Q109: Annuities, pensions, and retirement pay are reported

Q110: The control plan _, entails having paychecks

Q111: A(n) _ system is a computer based

Q112: The _ master data is the central

Q114: TB Figure 14.1 is a Level 0

Q115: A company that specializes in rendering payroll

Q116: The trigger for the payroll process "pay

Q117: For good internal control, there should be

Q118: In a(n) _ bank account funds are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents