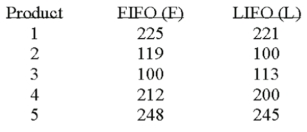

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

If you use the 5% level of significance, what is the critical t value?

A) +2.132

B) 2.776

C) +2.262

D) 102.228

Correct Answer:

Verified

Q60: The pooled estimate of the proportion is

Q66: A statistics professor wants to compare grades

Q68: If two dependent samples of size 100

Q74: A company is researching the effectiveness of

Q76: An investigation of the effectiveness of a

Q77: A company is researching the effectiveness of

Q78: A company is researching the effectiveness

Q80: Accounting procedures allow a business to evaluate

Q82: When testing the difference between two population

Q97: If we are testing for the difference

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents