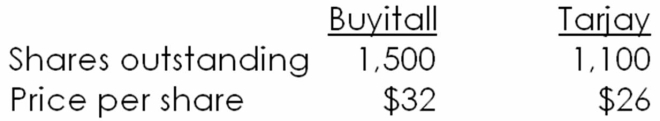

Consider the following premerger information about a bidding firm (Buyitall Inc.) and a target firm (Tarjay Corp.) .Assume that neither firm has any debt outstanding.  Buyitall has estimated that the present value of any enhancements that Buyitall expects from acquiring Tarjay is $2,600.What is the NPV of the merger assuming that Tarjay is willing to be acquired for $28 per share in cash?

Buyitall has estimated that the present value of any enhancements that Buyitall expects from acquiring Tarjay is $2,600.What is the NPV of the merger assuming that Tarjay is willing to be acquired for $28 per share in cash?

A) $400

B) $600

C) $1,800

D) $2,200

E) $2,600

F) None of the above.

Correct Answer:

Verified

Q12: Estimate BSL's value (in $ millions)at the

Q13: Assume that at year-end 2015 the company's

Q14: What is BSL's free cash flow (in

Q15: Atmosphere,Inc.has offered $860 million cash for all

Q16: Estimate BSL's value (in $ millions)at the

Q18: The following table presents forecasted financial and

Q19: The following table presents forecasted financial and

Q20: Assume BSL is worth the book value

Q21: The following table presents a four-year forecast

Q36: Empirical evidence indicates that the returns to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents