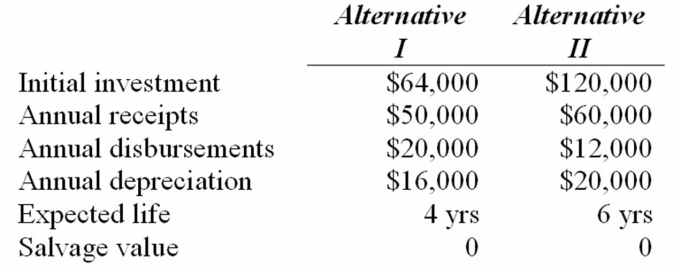

A company is considering two alternative methods of producing a new product.The relevant data concerning the alternatives are presented below.  At the end of the useful life of whatever equipment is chosen the product will be discontinued.The company's tax rate is 50 percent and its cost of capital is 10 percent.

At the end of the useful life of whatever equipment is chosen the product will be discontinued.The company's tax rate is 50 percent and its cost of capital is 10 percent.

a.Calculate the net present value of each alternative.

b.Calculate the benefit cost ratio for each alternative.

c.Calculate the internal rate of return for each alternative.

d.If the company is not under capital rationing,which alternative should be chosen?

Why?

Correct Answer:

Verified

NPVII = 34...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Sol's Sporting Goods is expanding,and as a

Q16: Your grandmother invested a lump sum 26

Q17: Your brother will borrow $17,800 to buy

Q18: Naomi plans on saving $3,000 a year

Q19: Pro forma free cash flows for a

Q20: Ian is going to receive $20,000 six

Q22: Consider the following investment opportunity.

Q23: Your brother,age 40,is the regional manager at

Q24: Ten years ago you invested $1,000 for

Q25: Given the following information about a possible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents