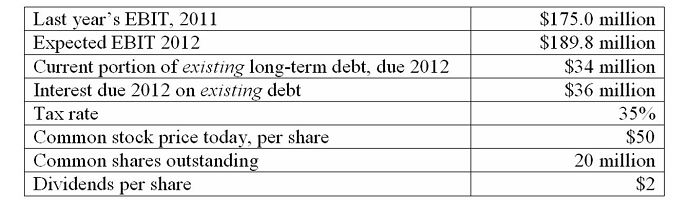

As CFO of Nile Holdings, a carpet wholesaler, you have the following information as of December 2011:

-Assume Nile raises $100 million of new debt at the end of 2011,at an interest rate of 7%.

a.Calculate the firm's pro forma 2012 times interest earned (TIE)ratio.

b.Calculate the percentage EBIT can fall (below expected EBIT)before interest coverage dips below 1.0.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: As CFO of Nile Holdings, a carpet

Q15: In general,the capital structures used by non-financial

Q16: According to the pecking-order theory proposed by

Q17: Which of the following is NOT a

Q18: The interest tax shield has no value

Q19: The basic lesson of the M&M theory

Q21: Calculate next year's times burden covered ratio

Q22: Suppose Nile expects $4.52 in EPS next

Q24: Calculate next year's earnings per share assuming

Q28: Can a company incur costs of financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents