Tax Fighters,Inc.,develops,markets,and sells software for tax preparation.Tax Fighters,Inc.sells IRS Tax Fighter,a software for completing federal income tax forms and Gopher Basher,a software for completing Minnesota state income tax forms.For simplicity,assume that all of the costs in this industry are the fixed costs of developing the software packages themselves.The marginal cost of producing another disk is approximately zero.

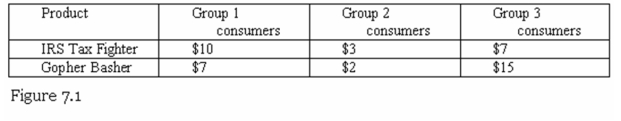

Consider the following information about the demand for tax software.There are an equal number of consumers in each group.Figure 7.1 shows the maximum that each type of consumer is willing to pay for each product.As vice president for pricing,explain your optimal bundling and pricing strategy to maximize Tax Fighter profits from the sale of tax software.Be sure to clearly explain why your strategy is.optimal.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: If Tiger Toys faces a demand curve

Q5: Using the linear approximation system to estimate

Q6: The difference between what a consumer is

Q7: The simple case of pricing with market

Q8: If Tiger Toys faces a demand curve

Q10: A typical university football program requires alumni

Q11: Two consumers,1 and 2,of the same product

Q12: Great Nuggets finds that there is a

Q13: Wet-n-Wild Indoor Water Park offers family fun

Q14: If Tiger Toys faces a demand curve

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents