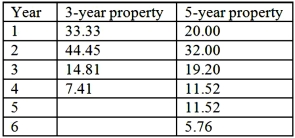

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's combined income tax rate is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below.  What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

A) $62,000.

B) $114,000.

C) $170,000.

D) $240,000.

E) $37,000.

Correct Answer:

Verified

Q62: Carmino Company is considering an investment

Q63: XYZ Corporation is contemplating the replacement of

Q66: Quip Corporation wants to purchase a new

Q67: Income tax effects are associated with all

Q68: Quip Corporation wants to purchase a new

Q72: Pique Corporation wants to purchase a new

Q73: Quip Corporation wants to purchase a new

Q74: Carmino Company is considering an investment

Q76: Which of the following would not be

Q77: Quip Corporation wants to purchase a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents