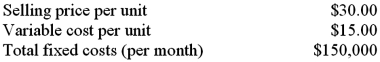

Fashions, Inc. is a retail store that sells sweaters and jackets. In the past, it has bought all its sweaters from a supplier for $20 per unit and had no fixed costs for this line of clothing. However, Fashions has the opportunity to acquire a small manufacturing facility where it could produce its own sweaters. The projected data for producing its own sweaters are as follows:  Required:

Required:

1. If Fashions acquired the manufacturing facility, how many sweaters would it have to produce in order to break even? (Round your answer up, to the nearest whole number.)

2. To earn an after tax profit of $125,000 per month, how many sweaters would Fashions have to sell if it buys the sweaters from the supplier? If it produces its own sweaters? Fashion's combined income tax rate is 30%. (Round your answer up, to the nearest whole number.)

3. What is the profit-indifference sales volume in terms of the two options under consideration? (Ignore income tax effects.) Show a computation of operating income to prove your answer.

Correct Answer:

Verified

Feedback: 1. BE point, i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Cathy's Towels sells three items (which it

Q70: The degree of operating leverage (DOL), at

Q75: Cleaning Care Inc. expects to sell 10,000

Q80: Which of the following entities can use

Q81: Gallery 12 Company operates the franchise for

Q81: Income taxes have the following effect on

Q83: Daley Co. manufactures computer monitors. Following is

Q85: Daley Co. manufactures computer monitors. Following is

Q87: The form of the income statement that

Q87: Daley Co. manufactures computer monitors. Following is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents