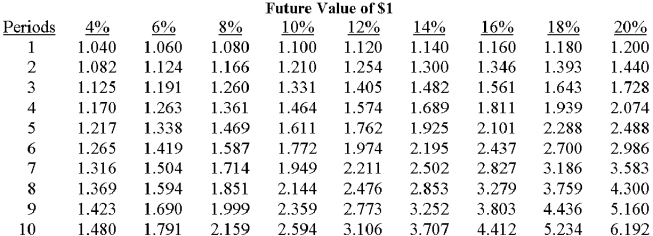

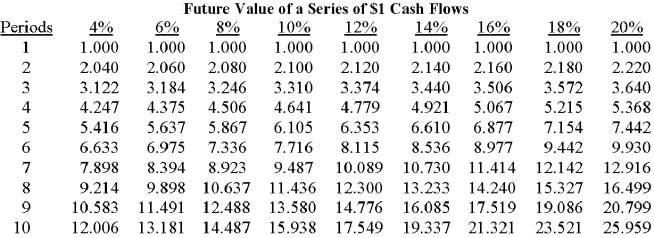

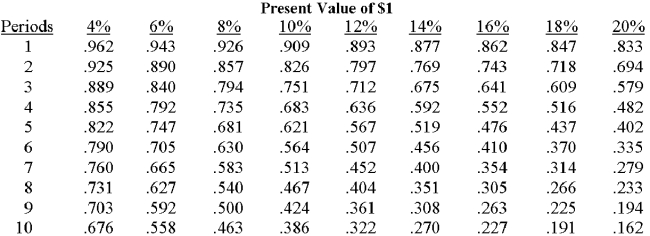

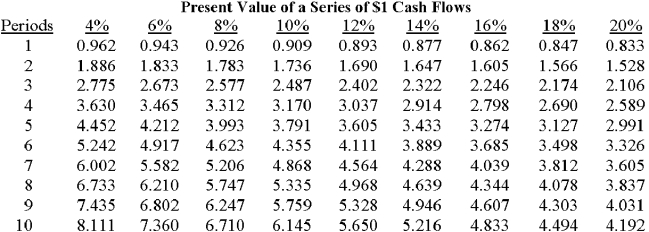

st.Augustine can acquire a $700,000 machine now that will benefit the firm over the next 5 years.A newly hired staff assistant correctly computed the net present value to be $134,020 by using a 10% hurdle rate.On the basis of this information,the machine was expected to produce annual cash operating savings of approximately:

A) $166,804.

B) $220,000.

C) $268,605.

D) $834,020.

E) some other amount.

Correct Answer:

Verified

Q35: Q36: The systematic follow-up on a capital project Q37: A company's hurdle rate is generally influenced Q38: Q39: The rule for project acceptance under the Q41: Bath Works Company has $70,000 of depreciation Q41: Generally speaking, which of the following would Q42: When income taxes are considered in capital Q44: A company that uses accelerated depreciation: Q46: When a company is analyzing a capital![]()

![]()

A)would write

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents