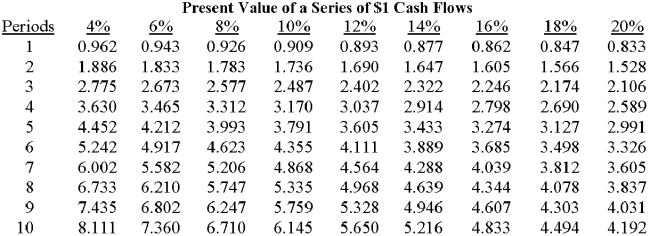

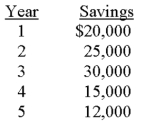

The mayor of Statesville is considering the purchase of a new computer system for the city's tax department.The system costs $75,000 and has an expected life of five years.The mayor estimates the following savings will result if the system is purchased:

Statesville uses a 10% discount rate for capital-budgeting decisions.

A salesperson from a different computer company claims that his machine,which costs $85,000 and has an estimated service life of four years,will generate annual savings for the city of $32,000.If the discount rate is 10%,the net present value of this system would be:

A) $16,440.

B) $23,175.

C) $63,512.

D) $101,440.

E) some other amount.

Correct Answer:

Verified

Q13: The internal rate of return equates the

Q20: Q23: The rule for project acceptance under the Q24: Which of the following choices correctly states Q25: Which of the following choices correctly states Q26: Discounted-cash-flow analysis focuses primarily on: Q27: Consider the following factors related to an![]()

A) the stability

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents