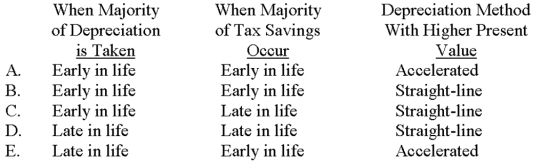

Preston Company is considering the use of accelerated depreciation rather than straight-line depreciation for a new asset acquisition.Which of the following choices correctly shows when the majority of depreciation would be taken (early or late in the asset's life) ,when most of the tax savings occur (early or late in the asset's life) ,and which depreciation method would have the higher present value?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q28: Hightower Company plans to incur $350,000 of

Q43: Hazeldine Company plans to incur $230,000 of

Q48: When income taxes are considered in capital

Q49: A depreciation tax shield is a(n):

A)after-tax cash

Q50: Assume that a capital project is being

Q52: A company's cash flows for income taxes

Q53: Jenkins plans to generate $650,000 of sales

Q55: Of the five expenses that follow,which one

Q61: Consider the following statements about depreciation tax

Q67: Which of the following is the proper

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents