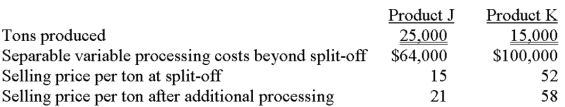

Indiana Corporation has $200,000 of joint processing costs and is studying whether to process J and K beyond the split-off point.Information about J and K follows.

If Indiana desires to maximize total company income,what should the firm do with regard to Products J and K?

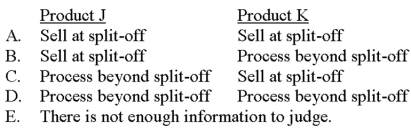

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q43: Ortega Interiors provides design services to residential

Q45: When deciding whether to sell a product

Q56: A company that is operating at full

Q59: Summers Corporation is composed of five divisions.Each

Q61: If Smythe follows proper managerial accounting practices,how

Q62: Assuming there is unlimited demand for both

Q63: Which of the following is a

Q64: Phanatix,Inc.produces a variety of products that carry

Q73: Use the following information to answer the

Q77: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents