Cornwall Corporation manufactures faucets.Several weeks ago,the company received a special-order inquiry from Yates,Inc.Yates desires to market a faucet similar to Cornwall's model no.55 and has offered to purchase 3,000 units.The following data are available:

· Cost data for Cornwall's model no.55 faucet: direct materials,$45;direct labor,$30 (2 hours at $15 per hour);and manufacturing overhead,$70 (2 hours at $35 per hour).

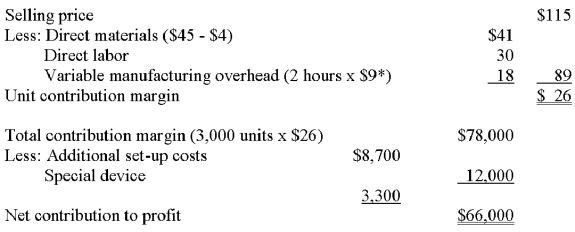

· The normal selling price of model no.55 is $180;however,Yates has offered Cornwall only $115 because of the large quantity it is willing to purchase.

· Yates requires a design modification that will allow a $4 reduction in direct-material cost.

· Cornwall's production supervisor notes that the company will incur $8,700 in additional set-up costs and will have to purchase a $3,300 special device to manufacture these units.The device will be discarded once the special order is completed.

· Total manufacturing overhead costs are applied to production at the rate of $35 per labor hour.This figure is based,in part,on budgeted yearly fixed overhead of $624,000 and planned production activity of 24,000 labor hours.

· Cornwall will allocate $5,000 of existing fixed administrative costs to the order as "¼part of the cost of doing business."

Required:

A.One of Cornwall's staff accountants wants to reject the special order because "financially,it's a loser." Do you agree with this conclusion if Cornwall currently has excess capacity? Show calculations to support your answer.

B.If Cornwall currently has no excess capacity,should the order be rejected from a financial perspective? Briefly explain.

B.Yes,the order should be rejected.An environment of no excess capacity implies a very strong marketplace.Cornwall would be giving up sales at $180 per faucet,to be replaced with sales of $115 per unit and the need to incur additional set-up costs and the cost of a special device.Company profitability would suffer.

C.Assume that Cornwall currently has no excess capacity.Would outsourcing be an option that Cornwall could consider if management truly wanted to do business with Yates? Briefly discuss,citing several key considerations for Cornwall in your answer.

No,the conclusion is incorrect because the order generates a net contribution of $66,000 for the firm.Note: The fixed administrative cost is irrelevant to the decision.

*Fixed manufacturing overhead: $624,000 / 24,000 labor hours = $26 per hour

Variable manufacturing overhead: $35 - $26 = $9

C.Yes,outsourcing is an option.Cornwall could have another manufacturer produce the faucets for Yale or perhaps even for another customer.Price,product quality,and supplier reliability would be important considerations in this decision.As in all special order decisions,if Cornwall's regular customers find out that Yates is purchasing the faucets at a lower price than them,there may be negative repercussions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: If Smythe follows proper managerial accounting practices,how

Q62: Assuming there is unlimited demand for both

Q63: Which of the following is a

Q64: Phanatix,Inc.produces a variety of products that carry

Q68: George Jettson builds custom homes in Cincinnati.Jettson

Q69: The following costs relate to a variety

Q70: If Smythe follows proper managerial accounting practices,which

Q71: Buchnell Manufacturing has 31,000 labor hours available

Q73: Use the following information to answer the

Q74: A technique that is useful in exploring

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents