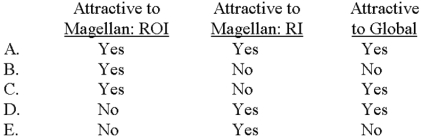

The Magellan Division of Global Corporation,which has income of $250,000 and an asset investment of $1,562,500,is studying an investment opportunity that will cost $450,000 and yield a profit of $67,500.Assuming that Global uses an imputed interest charge of 14%,would the investment be attractive to:

1-Divisional management if ROI is used to evaluate divisional performance?

2-Divisional management if residual income (RI) is used to evaluate divisional performance?

3-The management of Global Corporation?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q17: The income calculation for a division manager's

Q19: Which of the following is not considered

Q22: The Fitzhugh Division of General Enterprises has

Q25: For the period just ended,United Corporation's Delta

Q26: Excel Division reported a residual income of

Q27: For the period just ended,Techno Corporation's Stocker

Q28: Sunrise Corporation has a return on investment

Q29: BFF Corporation uses an imputed interest rate

Q42: Use the following information to answer the

Q53: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents