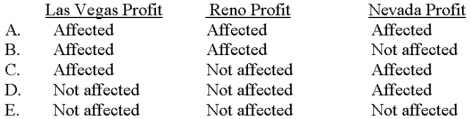

Nevada,Inc.has two divisions,one located in Las Vegas and the other located in Reno.Las Vegas sells selected goods to Reno for use in various end-products.Assume that the transfer between the two divisions takes place irregardless of the transfer price set by Las Vegas.Which of the following correctly describes the impact of the transfer prices on divisional profits and overall company profit?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q45: When an organization allows divisional managers to

Q48: Which of the following elements is not

Q49: The following information relates to Hudston,Inc.:

Q50: Hallen Division has been stagnant over the

Q52: Thurmond,Inc.has two divisions,one located in New York

Q56: The income calculation for a division manager's

Q57: Sahara Corporation has no excess capacity. If

Q60: The market value of Glenwood's debt and

Q73: The amounts charged for goods and services

Q79: A general calculation method for transfer prices

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents