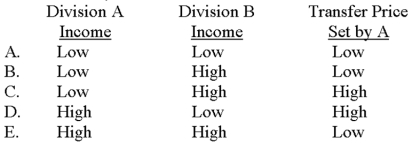

Division A transfers a profitable subassembly to Division B,where it is assembled into a final product.A is located in a European country that has a high tax rate;B is located in an Asian country that has a low tax rate.Ideally,(1) what type of before-tax income should each division report from the transfer and (2) what type of transfer price should Division A set for the subassembly?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q61: Use the following information to answer the

Q71: Sonoma Corporation is a multi-divisional company whose

Q72: Tunley Corporation has excess capacity. If the

Q73: Green Auto's Northern Division is currently purchasing

Q75: Use the following information to answer the

Q76: Underwood Company uses cost-based transfer pricing. Its

Q78: Gamma Division of Vaughn Corporation produces electric

Q79: McKenna's Florida Division is currently purchasing a

Q80: The following data pertain to Corkscrew Corporation:

Q85: Cheney Corporation produces goods in the United

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents