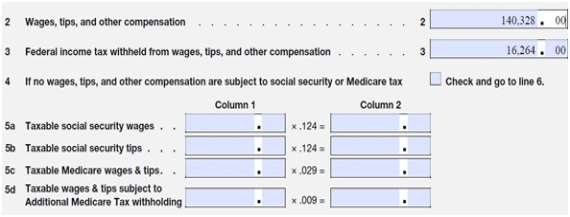

McBean Farms has the following information on their Form 941:

What amount should be entered in Column 2,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $17,400.67 and $4,069.51,respectively

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

Correct Answer:

Verified

Q8: An employer files Form 941 on either

Q15: Payroll taxes for which the employer is

Q21: Andreosatos Enterprises has received a letter from

Q24: Hodgdon Industries,a semi-weekly schedule depositor,pays its employees

Q26: Collin's Pool Service files a Form 944

Q28: Collin's Pool Service files a Form 944

Q28: McBean Farms has the following information on

Q30: Patalano's Pros is a semiweekly schedule depositor.Which

Q38: Van Buuren Enterprises had payroll tax liability

Q59: Which copy of Form W-2 should be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents