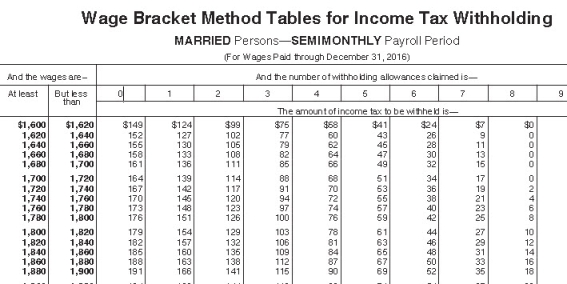

Melody is a full-time employee in Sioux City,South Dakota,who earns $3,600 per month and is paid semimonthly.She is married with 1 withholding allowance (use the wage-bracket tables) .She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k) ,both of which are pre-tax deductions.What is her net pay? (Do not round interim calculations,only round final answer to two decimal points. )

A) $1,696.00

B) $1,524.27

C) $1,426.13

D) $1,394.87

Correct Answer:

Verified

Q23: Disposable income is defined as:

A)An employee's net

Q31: Adam is a part-time employee who earned

Q33: Wyatt is a full-time exempt music engineer

Q35: Julio is single with 1 withholding allowance.He

Q36: Warren is a married employee with six

Q38: Ross is a full-time employee in Provo,Utah,who

Q39: Jeannie is an adjunct faculty at a

Q40: Andie earned $680.20 during the most recent

Q48: Which of the following is the correct

Q59: Which body issued Regulation E to protect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents