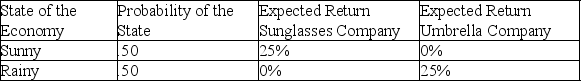

Denard has two investment opportunities. He can invest in The Sunglasses Company or The Umbrella Company. If he diversifies his investment by putting 50% of his money into each company, what is the expected return and standard deviation of his portfolio?

A) The expected return for the portfolio is 12.50% and the standard deviation 0.00%.

B) The expected return for the portfolio is 25.00% and the standard deviation 0.00%.

C) The expected return for the portfolio is 12.50% and the standard deviation 12.50%.

D) The expected return for the portfolio is 25.00% and the standard deviation 25.00%.

Correct Answer:

Verified

Q63: Which of the following securities could NOT

Q64: For purposes of maximum portfolio diversification, which

Q64: You wish to diversify your single-security portfolio

Q65: Unsystematic risk _.

A)is also known as nondiversifiable

Q65: Which of the following statements is FALSE?

A)

Q66: Denard has two investment opportunities. He can

Q66: Diversification is

A)not putting all of your eggs

Q68: If two investments have the same expected

Q69: The type of risk that can be

Q73: What are the two investment rules identified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents