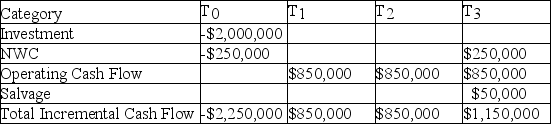

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 14.00%, what is the NPV of the project, given the expected cash flows listed here?

A) -$74,121

B) $499,604

C) $2,175,879

D) $2,479,604

Correct Answer:

Verified

Q61: Generally speaking,when the information is available,investors prefer

Q62: It is necessary to assign the appropriate

Q65: Randy's Ranch House Café has an adjusted

Q66: Your firm has an average-risk project under

Q67: The following market information was gathered for

Q67: Equity is an attractive form of financing

Q68: When estimating a weighted average cost of

Q71: Takelmer Industries has a different WACC for

Q72: The formula for the WACC adjusted =

Q73: Your firm has an average-risk project under

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents