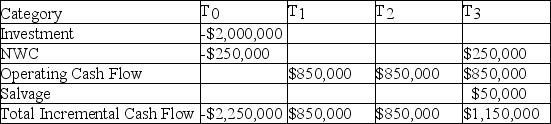

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 14.00%, what is the IRR of the project given the expected cash flows listed here? Use a financial calculator to determine your answer.

A) About 12.13%

B) About 14.00%

C) About 24.95%

D) There is not enough information to answer this question.

Correct Answer:

Verified

Q63: When possible,investors and analysts prefer to use

Q65: Investors _ for estimating the WACC.

A)are indifferent

Q66: The following market information was gathered for

Q73: To estimate the market value of a

Q73: Your firm has an average-risk project under

Q77: Your firm has an average-risk project under

Q77: If all projects are assigned the same

Q82: You have learned how to use NPV

Q83: The best rule for choosing projects when

Q83: Red Rider Bike Shop (RRBS) has an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents