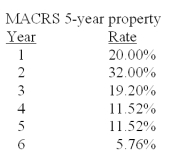

You own some equipment which you purchased three years ago at a cost of $135,000.The equipment is 5-year property for MACRS.You are considering selling the equipment today for $82,500.Which one of the following statements is correct if your tax rate is 34%?

A) The book value today is $64,320.

B) The taxable amount on the sale is $38,880.

C) The tax due on the sale is $14,830.80

D) The book value today is $8,478.

E) You will receive a tax refund of $13,219.20 as a result of this sale.

Correct Answer:

Verified

Q44: Kurt's Kabinets is looking at a project

Q45: LiCheng's Enterprises just purchased some fixed assets

Q47: Wilbert's,Inc.paid $80,000,in cash,for a piece of equipment

Q48: Walks Softly,Inc.sells customized shoes.Currently,they sell 10,000 pairs

Q50: Jamie's Motor Home Sales currently sells 1,000

Q50: A project will increase sales by $140,000

Q51: Ronnie's Coffee House is considering a project

Q52: You just purchased some equipment that is

Q53: Ernie's Electrical is evaluating a project which

Q58: Peter's Boats has sales of $760,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents