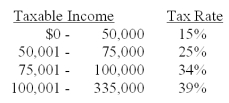

Given the tax rates as shown,what is the average tax rate for a firm with taxable income of $126,500?

A) 21.38%

B) 23.88%

C) 25.76%

D) 34.64%

E) 39.00%

Correct Answer:

Verified

Q22: A firm starts its year with a

Q31: When you are making a financial decision,the

Q36: The cash flow to creditors includes the

Q37: Assets are listed on the balance sheet

Q41: Cash flow to stockholders is defined as:

A)interest

Q45: According to generally accepted accounting principles (GAAP),revenue

Q46: Your firm has net income of $198

Q47: Net capital spending is equal to:

A)net additions

Q48: Under GAAP, a firm's assets are reported

Q49: Which of the following statements concerning the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents