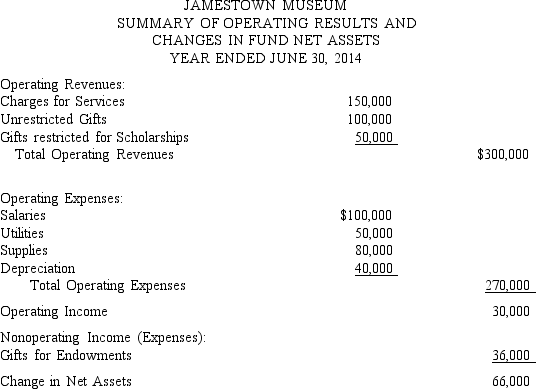

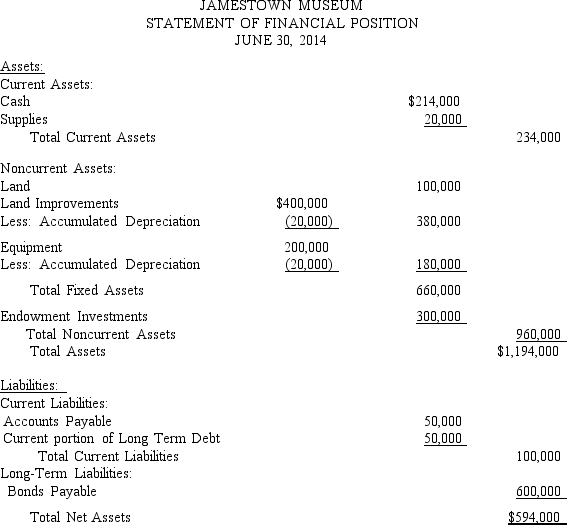

Below are the complete set of published financial statements taken from the annual report of the Jamestown Museum.The statements do not comply with generally accepted accounting principles for private not-for-profits in a number of ways.Review these statements and describe instances in which the statements fail to comply with accepted accounting standards.You must be able to justify your assertions - for example you cannot say they failed to capitalize leases if there is no evidence they have a qualifying lease.

Example:

(1)The financial statements contain no note disclosures.The notes are an integral part of the financial statements and many individual disclosures are required under FASB standards.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: How does a for-profit organization record contributions

Q129: If a person names a private not-for-profit

Q133: Which of the following is not an

Q137: How is the receipt of an unconditional

Q141: FASB Statement 136 Transfer of Assets to

Q142: Contrast the reporting of mergers and acquisitions

Q144: Assume that The Sandy Creek Nature Center,a

Q147: Assume Towne Center Art Museum received the

Q151: Distinguish between an exchange transaction and a

Q159: What are the criteria established by Statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents