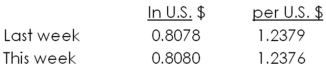

You are given the following exchange rates for the Canadian dollar versus the U.S.dollar:  Which one of the following statements is correct given this information?

Which one of the following statements is correct given this information?

A) Last week, it took Can$0.8078 to purchase US$1.

B) This week you can exchange one Canadian dollar for $1.2376 American.

C) It is cheaper for an American to travel in Canada this week as compared to last week.

D) The Canadian dollar depreciated from last week to this week.

E) You would have made a profit if you invested U.S. $100 in Canadian dollars last week and then converted your money back to U.S. dollars this week. Ignore any interest earnings.

Correct Answer:

Verified

Q23: Relative purchasing power parity is based on

Q24: Assume that PE is the euro price

Q26: Which of the following are participants in

Q27: Which one of the following best describes

Q28: Interest rate parity defines the relationships among

Q30: Assume a canned soft drink costs $1

Q32: You have just agreed to a forward

Q33: Which one of the following must be

Q34: Later this week, you are traveling from

Q35: Short-run exposure to exchange rate risk is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents