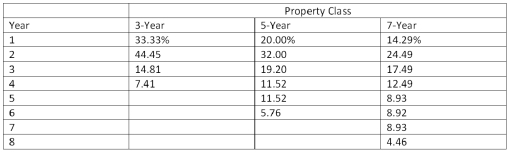

An asset used in a three-year project falls in the five-year MACRS class for tax purposes.The asset has an acquisition cost of $5.4 million and will be sold for $1.2 million at the end of the project.If the tax rate is 35 percent,what is the aftertax salvage value of the asset?  Table 9.7 Modified ACRS depreciation allowances

Table 9.7 Modified ACRS depreciation allowances

A) $1,075,680

B) $780,000

C) $904,320

D) $1,324,320

E) $1,187,560

Correct Answer:

Verified

Q82: Industrial Services is analyzing a proposed investment

Q83: You are analyzing a project and have

Q84: A project has an initial requirement of

Q85: You are analyzing a project and have

Q86: Lakeside Winery is considering expanding its winemaking

Q88: Miller Lite,Inc.is considering a new four-year expansion

Q89: The Golf Range is considering adding an

Q90: Outdoor Sports is considering adding a miniature

Q91: Consider an asset that costs $465,000 and

Q92: You are analyzing a project and have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents