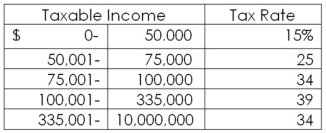

Able Co.has $218,000 in taxable income and Bravo Co.has $5,600,000 in taxable income.Suppose both firms have identified a new project that will increase taxable income by $12,000.The additional project will increase Able Co.'s taxes by _____ and Bravo Co.'s taxes by ____.

A) $1,800; $1,800

B) $4,080; $4,080

C) $4,080; $4,680

D) $4,680; $4,080

E) $4,680; $4,680

Correct Answer:

Verified

Q86: The Carpentry Shop has sales of $398,600,

Q97: A firm has earnings before interest and

Q98: Six months ago,Benders Gym repurchased $20,000 of

Q100: The Underground Cafe has an operating cash

Q101: The Play House's December 31,2013,balance sheet showed

Q103: Precision Manufacturing had the following operating results

Q104: Gorman Distributors shows the following information on

Q105: The December 31,2013,balance sheet of Suzette's Market

Q106: Which is more important from a finance

Q107: Identify the cash flows that occur between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents