The City of Thomasville maintains its books so as to prepare fund accounting statements and prepares worksheet adjustments in order to prepare government-wide financial statements. Required:

You are to prepare,in journal form,worksheet adjustments for each of the following situations.

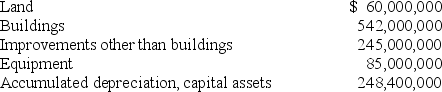

A.General fixed assets,as of the beginning of the year,which had not been recorded,were as follows:

B.During the year,expenditures for capital outlays amounted to $14,250,000.Of that amount,$11,900,000 was for buildings; $1,950,000 was for improvements other than buildings,$ 10,000 was capitalized interest and the remainder was for land.

B.During the year,expenditures for capital outlays amounted to $14,250,000.Of that amount,$11,900,000 was for buildings; $1,950,000 was for improvements other than buildings,$ 10,000 was capitalized interest and the remainder was for land.

C.The capital outlay expenditures outlined in (B)were completed at the end of the year (no depreciation until next year). For purposes of financial statement presentation,all capital assets are depreciated using the straight-line method,with no estimated salvage value. Estimated lives are as follows:

buildings,50 years; improvements other than buildings,20 years; equipment,10 years.

D.Equipment with a cost of $ 90,000 and accumulated depreciation at the time of sale of $60,000 was sold for $25,000.

Correct Answer:

Verified

Q121: Internal service funds are most commonly reported

Q123: Which of the following would not be

Q126: Identify and describe the required supplementary information

Q130: The following entries were in the governmental

Q131: With regard to the government-wide statements,list the

Q132: When converting fund financial records to government-wide

Q136: Which of the following would not need

Q145: With regard to the government-wide statements, distinguish

Q151: With regard to the government-wide statements, indicate

Q155: With regard to the government-wide statements, indicate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents