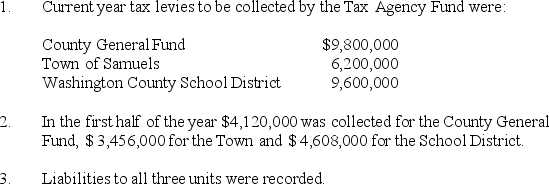

Washington County assumed the responsibility of collecting property taxes for all governments within its boundaries. In order to reimburse the county for expenditures for administering the Tax Agency Fund,the Tax Agency Fund is to deduct 1.5 percent from the collections from the city and school district. The total amount deducted is to be added to the collections for the county and remitted to the County General Fund. You are to record the following transactions in the accounts of the Washington County Tax Agency Fund.

Correct Answer:

Verified

Q122: Contrast a defined benefit and defined contribution

Q125: Contrast the purpose of Private-purpose Trust Funds

Q128: Contrast the accounting and reporting of Private-purpose

Q129: What are the four types of fiduciary

Q129: On July 1,2014,the City of Corfu received

Q132: What is a cost sharing state pension

Q134: Jefferson County maintains a tax agency fund

Q138: Which fund is used when a contributor

Q141: Describe the accounting treatment of investments with

Q143: Describe the accounting treatment of Agency Funds,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents