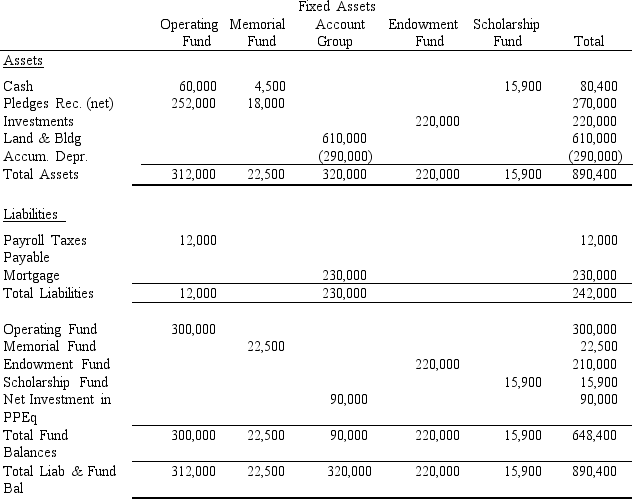

Union Seminary uses the fund basis of accounting for internal record keeping. Presented below is the fully adjusted 12/31/2015 balance sheet for Union,prepared using funds and account groups.The following are fund descriptions:

•Operating Fund - the fund used for transactions not falling within the definition of other funds. There are no restrictions on these resources.

•Memorial Fund - Used to account for resources donated from outside parties for specific capital additions

•Endowment Fund - Assets received from an outside donor for permanent investment,only the earnings may be expended.

•Scholarship Fund - Cash set aside by the Seminary's governing board for use as scholarships and student aid.

•Fixed Assets Account Group - A record of the Seminary's fixed assets and long-term debt.

Required:

Prepare a Statement of Financial Position following the guidelines provided in FASB Statements 116 and 117 for private not-for-profits and assuming Union does not classify plant assets as temporarily restricted.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: The equity section of the balance sheet

Q115: Which of the following is an example

Q116: Distinguish between (a)true endowments,(b)term endowments,and (c)quasi-endowments. Explain

Q117: Give 2 examples of unrestricted inflows,restricted inflows

Q119: What is the distinction between discounts and

Q120: How should the income earned by a

Q121: On January 1,2015,Antioch College,a private not-for-profit college,received

Q122: Ballard University,a private not-for-profit,billed four students for

Q123: Record the following transactions on the books

Q125: Ethan Allen University is a private university

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents