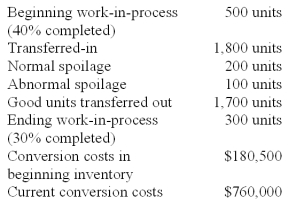

James Automotive Group is a maker of engines for high performance cars and uses a process costing system.The following information pertains to the final department of James' outstanding engine called "Superior-1".

James calculates separate costs of spoilage by computing both normal and abnormal spoiled units.Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss.The units of "Superior-1" that are spoiled are the result of defects not discovered before inspection of finished units.Using the weighted-average method,what are the unit conversion costs?

A) $46.70.

B) $363.64.

C) $450.00.

D) $536.36.

($180,500 + $760,000) /2,090 = $450

Correct Answer:

Verified

Q70: A Production Cost Report summarizes all except:

A)The

Q71: Which method is a method used to

Q73: James Automotive Group is a maker of

Q74: Which equation correctly calculates the total weighted

Q76: Place the following Process costing steps in

Q77: James Automotive Group is a maker of

Q78: Williams Pharmaceutical Company is a maker of

Q79: Backflush costing:

A)Is a simplified approach to determining

Q80: James Automotive Group is a maker of

Q95: Bob and Nancy Barnett have recently expanded

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents