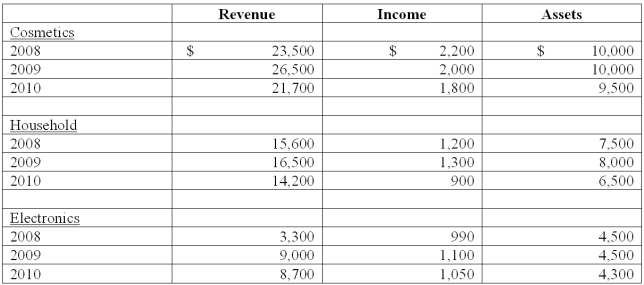

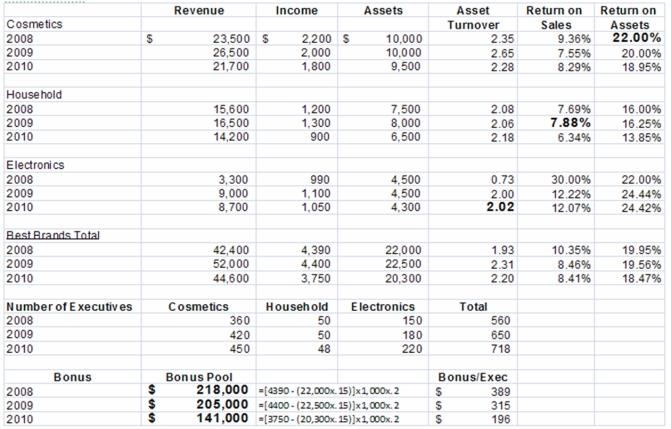

Best Brand Inc.(BBI) manufactures household goods in the United States.The company made two acquisitions in previous years to diversify its product lines.In 2005,HPI acquired cosmetics and consumer electronics companies.BBI is now,in 2010,comprised of three divisions: cosmetics,household,and consumer electronics.The following information (in thousands of dollars) presents operating revenues,operating income,and invested assets of the company over the last three years:

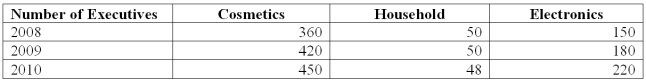

The following table shows the number of executives covered by the current compensation package of HPI:

The current compensation package is an annual bonus award.The senior executives share in the bonus pool.The pool is calculated as 20% of the annual residual income of the company.The residual income is defined as operating income minus a cost of capital charge of 15% of invested assets.Round all calculations to two significant digits.Return on assets for the cosmetics division in 2008 is:

A) 19.00%

B) 22.00%

C) 16.00%

D) 18.95%

Below

Correct Answer:

Verified

Q41: Which of the following is a liquidity

Q42: There is a common concern today that

Q43: Firms typically provide benefits (perks) to employees

Q49: Best Brand Inc.(BBI)manufactures household goods in the

Q50: Best Brand Inc.(BBI)manufactures household goods in the

Q51: EVA is the acronym for:

A)Extra Value Assets.

B)Economic

Q55: Which of the following aspects would not

Q56: Common bases of bonus compensation include:

Q58: In service firms, financial results can be

Q59: Which of the following would explain why

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents