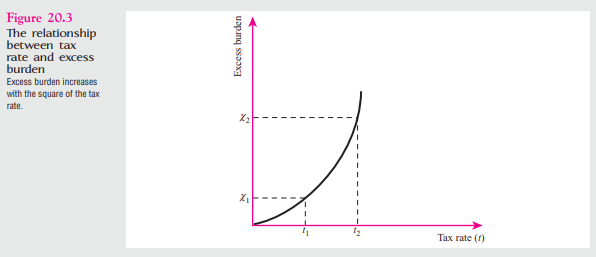

-Refer to Figure 20.3.Suppose the equation that equates excess burden to the tax rate can be written as EB = t2,where EB is excess burden and t is the tax rate.

(A)Suppose the tax rate t is initially 12 percent.How much excess burden is generated?

(B)If the tax rate doubles to 24 percent,what happens to excess burden?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: If raising taxes or borrowing are your

Q24: In the year 2008,nearly half of all

Q24: We have learned from this chapter that

Q25: You make a loan to the government

Q25: Ricardian view on debt is that the

Q26: From an efficiency standpoint,one must compare the

Q27: The deficits of the 1980s can be

Q31: Suppose,in 2008,the federal debt was $5 trillion.That

Q31: Total Government Debt is the sum of

Q32: If we assume that government borrowing crowds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents