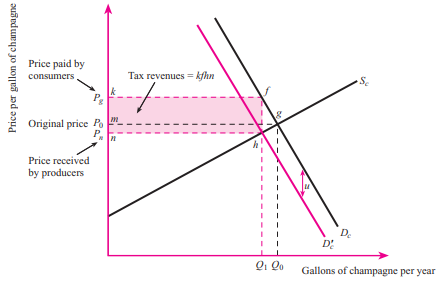

Figure 14.2

-Refer to Figure 14.2 .Suppose the original before-tax demand curve for CD players is P = 100 - 2Qd.Suppose further that supply is P = 5 + 3Qs.Now suppose a $5 unit tax is imposed on consumers.

(A)What is the before?tax equilibrium price and quantity?

(B)What is the after?tax equilibrium price and quantity?

(C)How much tax revenue is raised?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: An oligopoly has _ sellers in the

Q20: Statutory incidence of a tax deals with

A)

Q21: Why is it the case that a

Q22: Tax wedge is the difference between tax

Q23: Partial factor taxes are levied on an

Q27: Why is it the case that taxes

Q27: Ad valorem taxes create tax wedges just

Q28: Suppose that demand is perfectly inelastic.Supply is

Q29: Unit taxes cause shifts,while ad valorem taxes

Q37: Suppose there is a market that has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents