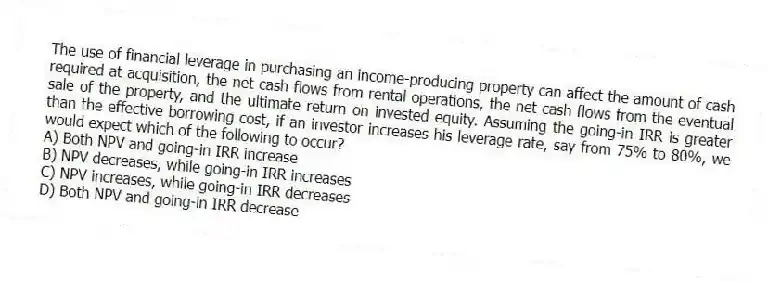

The use of financial leverage in purchasing an income-producing property can affect the amount of cash required at acquisition, the net cash flows from rental operations, the net cash flows from the eventual sale of the property, and the ultimate return on invested equity. Assuming the going-in IRR is greater than the effective borrowing cost, if an investor increases his leverage rate, say from 75% to 80%, we would expect which of the following to occur?

A) Both NPV and going-in IRR increase

B) NPV decreases, while going-in IRR increases

C) NPV increases, while going-in IRR decreases

D) Both NPV and going-in IRR decrease

Correct Answer:

Verified

Q14: To overcome the potential shortcomings of single-year

Q15: It is common for investors in real

Q16: While net present value (NPV) and internal

Q17: Given the following information, calculate the NPV

Q18: The internal rate of return (IRR) on

Q20: Based on your understanding of the differences

Q21: A client has requested advice on a

Q22: Given the following information regarding an income

Q23: Suppose an industrial building can be purchased

Q24: Determine the net present value (NPV) of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents