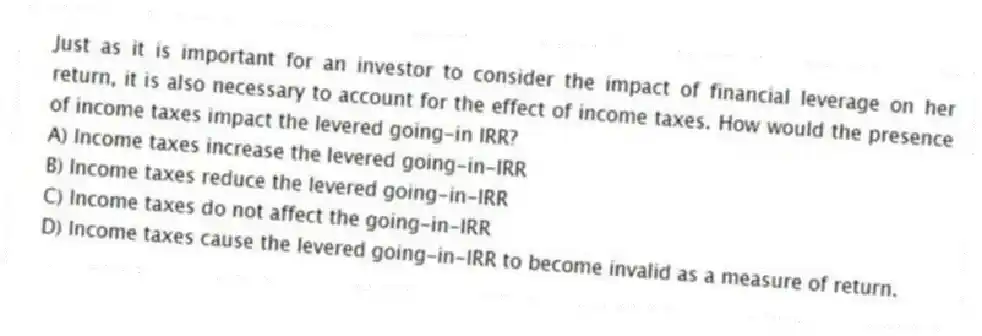

Just as it is important for an investor to consider the impact of financial leverage on her return, it is also necessary to account for the effect of income taxes. How would the presence of income taxes impact the levered going-in IRR?

A) Income taxes increase the levered going-in-IRR

B) Income taxes reduce the levered going-in-IRR

C) Income taxes do not affect the going-in-IRR

D) Income taxes cause the levered going-in-IRR to become invalid as a measure of return.

Correct Answer:

Verified

Q1: In discounted cash flow (DCF) analysis, the

Q2: While the general concepts of investment value

Q3: Many investors use mortgage debt to help

Q4: Net present value (NPV) is interpreted using

Q5: Given the following information, calculate the estimated

Q7: Given the following information, calculate the before-tax

Q8: An important piece of criteria for investors

Q9: Given the following information, calculate the appropriate

Q10: Changes in the discount rate used to

Q11: In discounted cash flow analysis, the industry

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents