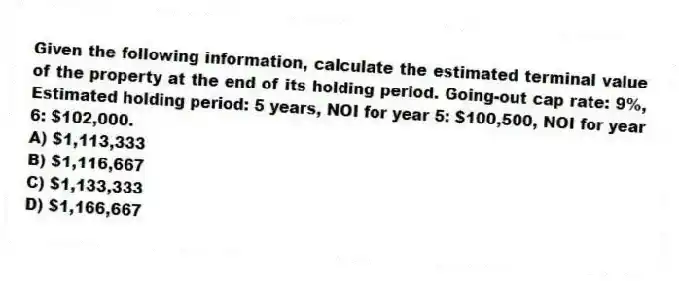

Given the following information, calculate the estimated terminal value of the property at the end of its holding period. Going-out cap rate: 9%, Estimated holding period: 5 years, NOI for year 5: $100,500, NOI for year 6: $102,000.

A) $1,113,333

B) $1,116,667

C) $1,133,333

D) $1,166,667

Correct Answer:

Verified

Q1: In discounted cash flow (DCF) analysis, the

Q2: While the general concepts of investment value

Q3: Many investors use mortgage debt to help

Q4: Net present value (NPV) is interpreted using

Q6: Just as it is important for an

Q7: Given the following information, calculate the before-tax

Q8: An important piece of criteria for investors

Q9: Given the following information, calculate the appropriate

Q10: Changes in the discount rate used to

Q11: In discounted cash flow analysis, the industry

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents