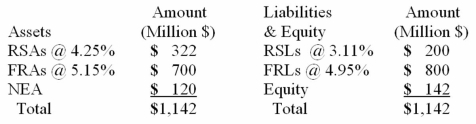

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixed-rate assets and liabilities (FRAs and FRLs) ; the rate of return and cost rates on the accounts are also given:  If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?

If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?

I. Long position in bond futures contracts

II. Buying put options on bonds

III. Purchasing an interest rate cap

A) I only

B) II only

C) III only

D) I and III only

E) II and III only

Correct Answer:

Verified

Q21: A macrohedge is a

A)hedge of a particular

Q25: The price of a bond rises from

Q27: A bond portfolio manager has a $25

Q29: Which of the following bond option positions

Q34: Plain vanilla interest rate swaps are exchanges

Q35: The profits on a derivatives position are

Q36: The safest way to hedge a bond

Q37: For a bond put option,the _ the

Q39: A microhedge is a

A)hedge of a particular

Q40: A forward contract

A)is marked to market.

B)has significant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents