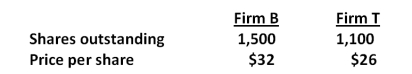

Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T) . Assume that neither firm has any debt outstanding.  Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,600. What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,600. What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

A) $400

B) $600

C) $1,800

D) $2,200

E) $2,600

Correct Answer:

Verified

Q63: Glendale Marine is being acquired by Inland

Q65: Aardvark Enterprises has agreed to be acquired

Q68: Pearl, Inc. has offered $860 million cash

Q70: Dressler, Inc., is planning on merging with

Q71: Merchantile Exchange is being acquired by National

Q73: Firm B is being acquired by Firm

Q78: George's Equipment is planning on merging with

Q83: Empirical evidence indicates that the returns to

Q85: Firms can frequently create synergy by merging

Q88: Identify the three basic legal procedures that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents