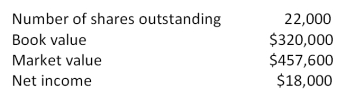

Birds and More is considering a project which requires the purchase of $164,000 of fixed assets. The net present value of the project is $4,500. Equity shares will be issued as the sole means of financing this project. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $20.68

B) $20.72

C) $20.80

D) $20.95

E) $21.10

Correct Answer:

Verified

Q64: Barstow Industrial Supply has decided to raise

Q65: The Motor Plant wants to raise $21.4

Q65: Kurt currently owns 3.4 percent of Northeastern

Q66: Outdoor Living needs $7.5 million to finance

Q70: The stock of Cleaner Home Products is

Q73: Northwest Rail wants to raise $14.2 million

Q78: You currently own 8 percent of the

Q86: Explain both a rights offering and the

Q89: Firms encounter several costs when issuing new

Q91: It can be argued that the decision

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents