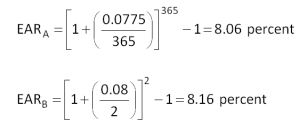

You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a rate of 7.75 percent, compounded daily. Loan B offers a rate of 8 percent, compounded semi-annually. Which loan should you select and why?

A) A; the effective annual rate is 8.06 percent.

B) A; the annual percentage rate is 7.75 percent.

C) B; the annual percentage rate is 7.68 percent.

D) B; the effective annual rate is 8.16 percent.

E) The loans are equivalent offers so you can select either onE.

Correct Answer:

Verified

Q88: You are borrowing money today at 8.48

Q90: City Bank wants to appear competitive based

Q92: Your credit card company charges you 1.65

Q92: The preferred stock of Casco has a

Q93: What is the effective annual rate if

Q96: You grandfather won a lottery years ago.The

Q99: You are paying an effective annual rate

Q100: Your credit card company quotes you a

Q100: You are going to loan a friend

Q101: Beginning three months from now, you want

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents