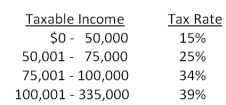

Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $311,360?

A) 28.25 percent

B) 31.09 percent

C) 33.62 percent

D) 35.48 percent

E) 39.00 percent

Correct Answer:

Verified

Q41: Which one of the following statements related

Q43: Crandall Oil has total sales of $1,349,800

Q48: Which one of the following is NOT

Q49: Jensen Enterprises paid $1,300 in dividends and

Q51: Jake owns The Corner Market which he

Q52: A firm has $520 in inventory,$1,860 in

Q53: Your firm has total assets of $4,900,

Q56: A positive cash flow to stockholders indicates

Q56: Winston Industries had sales of $843,800 and

Q60: Nielsen Auto Parts had beginning net fixed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents