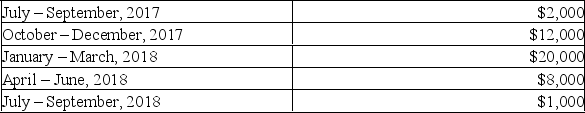

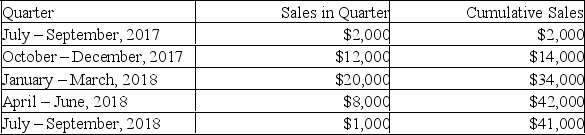

Sam began a small seasonal business in Prince Edward Island on July 1st,2017.He began operations slowly during the off-season,prior to a larger sales between October and March.Sam's sales of taxable supplies per quarter for the first fifteen months are provided for you here:

Required:

Required:

Apply the 'sales in quarter' and 'cumulative sales' tests to determine when Sam was required to become an HST registrant.Show your calculations and answer the following:

A.When did Sam lose his small supplier status?

B.What date was Sam required to start collecting HST?

C.By what date was Sam required to become an HST registrant?

Correct Answer:

Verified

Q1: Galaxy Wholesalers purchased inventory from a local

Q3: Jordan was required to pay her own

Q4: With respect to GST/HST,supplies fall under different

Q4: Green Co. earned $20,000 in revenue and

Q5: With respect to GST/HST,supplies fall under different

Q5: Blue Co. earned $80,000 in revenue and

Q7: The Little Company (TLC),located in British Columbia,provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents