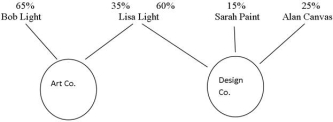

The following diagram depicts the ownership structure of two CCPCs.Bob Light is Lisa Light's son.Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner,whatsoever,or to one another.All of the shares held are common shares.

In 20xx,Art Co.earned $700,000 of active business income and Design Co.earned $500,000 of active business income.Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000.Art Co.reported $100,000 of adjusted aggregate investment income in the previous year.Design Co.did not report any investment income.The two companies have decided that Design Co.will not use any of the small business deduction in 20xx.The combined taxable capital of the two corporations is less than $10 million.(20xx is after 2018.)

Required:

A)Determine if the two companies are associated,referring to the applicable section of the Income Tax Act.

B)Calculate the amount available for the small business deduction to Art Co.in 20xx.

Correct Answer:

Verified

Q1: You have been provided with the following

Q2: There are several benefits to incorporating a

Q4: Which of the following scenarios are not

Q5: Private Co.received a $5,000 eligible dividend from

Q6: Chartered Tours Inc.(CTI)reported a net income for

Q8: Which of the following types of corporate

Q9: Bean Co. is a Canadian-controlled private corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents