Agatha earned $35,000 at her job during January 1st - October 10th of 20x4.She accepted a new position with the company in a town 1312 kilometres away and began the new job on November 1st,20x4,earning a gross salary of $4000 per month.

Agatha's moving expenses included:

$7,000 for a moving van

$300 for meals en route for Agatha and her 4 year old daughter on the four day drive

$700 for accommodations en route

$3000 ($150 per day)for 20 nights of temporary lodging in the new location until her apartment was available

$550 in gas receipts

She was not reimbursed for the move.

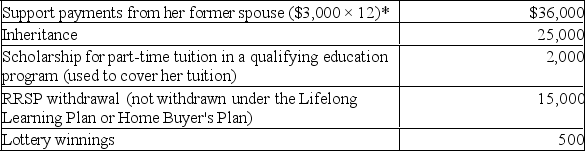

Agatha also received the following in 20x4:

*The support payments are in accordance with Agatha's divorce agreement,which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.

*The support payments are in accordance with Agatha's divorce agreement,which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.

Additional information:

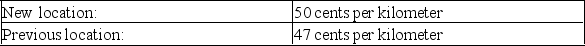

Assumed mileage rates:

Required:

Determine Agatha's minimum net income for tax purposes for 20x4 in accordance with Section 3 of the Income Tax Act.Show all calculations for her moving expenses and identify any amounts to be carried-forward.

Correct Answer:

Verified

Moving expenses

$7,000 moving van

$408...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following deductions are allowed

Q2: Car Co.is selling its land and building

Q2: Which of the following is FALSE regarding

Q3: Which of the following examples of income

Q4: Case One

Marsha had total income of $112,000

Q5: Indicate whether or not the parties in

Q8: In 20x4,Tom Depuis moved 2874 kilometers from

Q9: Identify whether the following sources of income

Q10: Steve gifted shares in a public corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents