Andy worked for High Speed Bikes Inc.from March 1st to December 31st during 20x1.He earned a monthly base salary of $4,000,plus 1% commission on all of his sales.During 20x1,Andy's sales totaled $800,000.Andy was required by his employer to pay for his employment expenses.He traveled out of his city most days in order to sell to customers in surrounding towns.He received a monthly allowance of $500 to cover his traveling costs (which has been accurately recognized as 'unreasonable').Andy and his employer each contributed $2,000 to the company's registered pension plan in 20x1

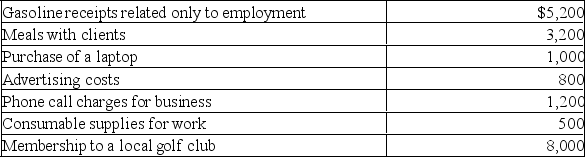

Andy provided you with the following receipts for 20x1:

Andy purchased a new vehicle for work during the year,and drove it a total of 25,000 kms while employed at High Speed Bikes.12,000 of these kilometres were for business.The vehicle cost Andy $32,000 plus GST of 5% and PST of 5%.Work-related interest payments on the car loan totaled $200 per month.

Andy purchased a new vehicle for work during the year,and drove it a total of 25,000 kms while employed at High Speed Bikes.12,000 of these kilometres were for business.The vehicle cost Andy $32,000 plus GST of 5% and PST of 5%.Work-related interest payments on the car loan totaled $200 per month.

Required:

Calculate Andy's employment income for 20x1 in accordance with Section 3 of the Income Tax Act

Correct Answer:

Verified

Q1: Susan was provided with a company car

Q1: Steven is employed by Big Rigs Inc.,

Q2: Which of the following factors are used

Q3: An individual has the option to receive

Q3: Cindy works for Sky Manufacturers Ltd.,which is

Q3: Which of the following, when provided by

Q4: Sarah borrowed $25,000 from her employer at

Q6: Kate Bell was employed by The Tea

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents