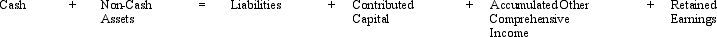

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for CX Corporation:

Using this analytical framework indicate the effect of each of the following transactions for CX Corporation:

1.CX Corporation purchases land for $450,000 cash.

2.At the end of the period CX Corporation receives an appraisal that values the land at $540,000.

3.During the next period CX Corporation sells the land for $665,000.

4.CX pays taxes at a rate of 40%.

Correct Answer:

Verified

Q62: Fellsmere Company's income tax return shows income

Q63: When income tax expense differs from income

Q63: The financial statement disclosures for Able Company,a

Q68: For some transactions GAAP requires that value

Q69: On December 31,2009,Loran Corporation reported a deferred

Q69: Discuss the two principal reasons income before

Q71: On January 1,2010,Starlight Company's balance sheet reported

Q72: Plaxo Corporation has a tax rate of

Q78: There are three valuation methods that reflect

Q79: For each of the items below,determine whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents