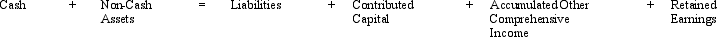

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

1.Staples recorded cash sales of $25,000.The merchandise had cost $19,000 to manufacture.

2.Staples purchased $8,500 of raw material inventory on account.

3.The company paid $2,500 for property insurance for the next 12 months.

4.Staples paid its employees $5,000 for the month.

5.The company purchased $1,000 of supplies on account.

6.Staples issued $25,000 of long-term debt.

7.The company used $10,000 of excess cash to purchase marketable securities.

8.Staples purchased a machine for $16,000 using $8,000 cash with the balance on account.

9.Staples paid $2,500 for interest expense on the long-term debt.

10.At the end of the year the marketable securities that Staples purchased in transaction 7 were now worth $14,500.

11.Depreciation for the period was $1,500.

12.Staples examined the equipment and determined that its fair value was $10,000.

Correct Answer:

Verified

Q53: Discuss the three ways in which GAAP

Q62: Fellsmere Company's income tax return shows income

Q67: H.Solo Company purchased a new piece of

Q68: For some transactions GAAP requires that value

Q69: Discuss the two principal reasons income before

Q72: Plaxo Corporation has a tax rate of

Q75: Jurgen Company's income tax return shows income

Q75: The analytical framework used to evaluate transactions

Q76: The analytical framework used to evaluate transactions

Q77: The following problem requires present value information:

Biotech

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents