Below is financial information for two restaurant retailers.Popper's Company operates an innovative retail bakery-cafe business and franchising business.At the end 2010,Popper's had 132 company-owned and 346 franchise-operated bakery-cafes.Popper's located most of their unique bakery-cafe concept stores in suburban,strip mall,and regional mall locations.As a first mover in this concept,the company operates in 32 states.Simmer Corporation began operations five years earlier than Popper's and purchases and roasts whole bean coffees and sells them,along with numerous coffee drinks and related products at over 2,900 Company-operated retail stores.

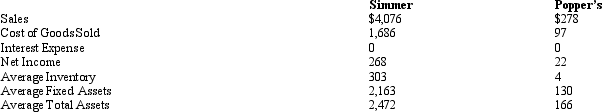

Selected Data for Popper's Company and Simmer Corporation

(amounts in millions)

Required:

Required:

a.Compute the rate of return on assets for each firm.Disaggregate the rate of return on assets into profit margin and assets turnover components.The income tax rate is 35%.

b.Describe the likely reasons for the differences in the profit margins and assets turnovers of the two companies.

Correct Answer:

Verified

Q65: EPS is an ambiguous measure of profitability

Q72: Accounts receivable turnover is calculated by dividing

Q77: Return on assets can be a misleading

Q78: When calculating return on common stockholders' equity

Q79: Inventory turnover is calculated by dividing _

Q82: Use the following information about Sanibel Corporation

Q83: Linda's Clothing is a retailer of contemporary

Q84: Carridine Company reported net income of $1,903

Q84: Sensitron and Douglas Tools manufacture and market

Q85: Below is financial information for two sporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents